Ultima Trading is an automated trading bot designed exclusively for spot trading in the TPTU/USDT pair. To start generating profit, you need to purchase a license and connect your BingX account to the bot — it will trade based on predefined algorithms and generate profit for you.

The bot uses three trading strategies simultaneously: Price Breakout Strategy, GRID SHORT Strategy and GRID LONG Strategy.

These strategies are perfectly suited for all market conditions. In this guide, we’ll take a detailed look at each one.

PRICE BREAKOUT STRATEGY

- At the first launch, the bot executes a market buy using 50% of your package value and places a limit sell order at a price 5% higher than the purchase price.

- For example, if you’ve purchased a Basic-level bot license for 550 EUR (equivalent to 605 USDT), the bot will execute a purchase of 302.5 USDT. Let’s assume the price of TPTU at the time of purchase was 1 USDT. The bot will place a limit sell order at 5% above the purchase price — at 1.05 USDT.

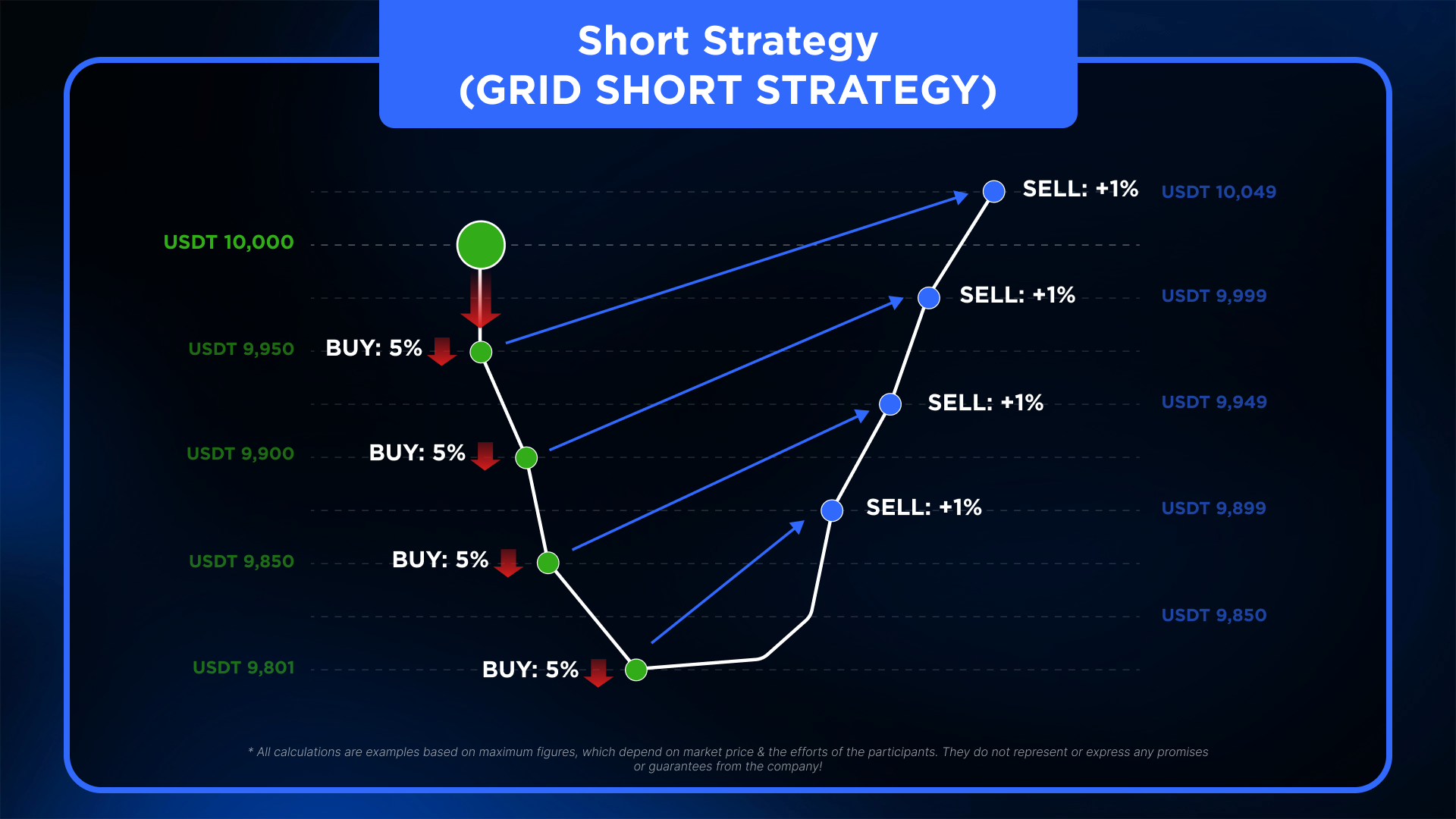

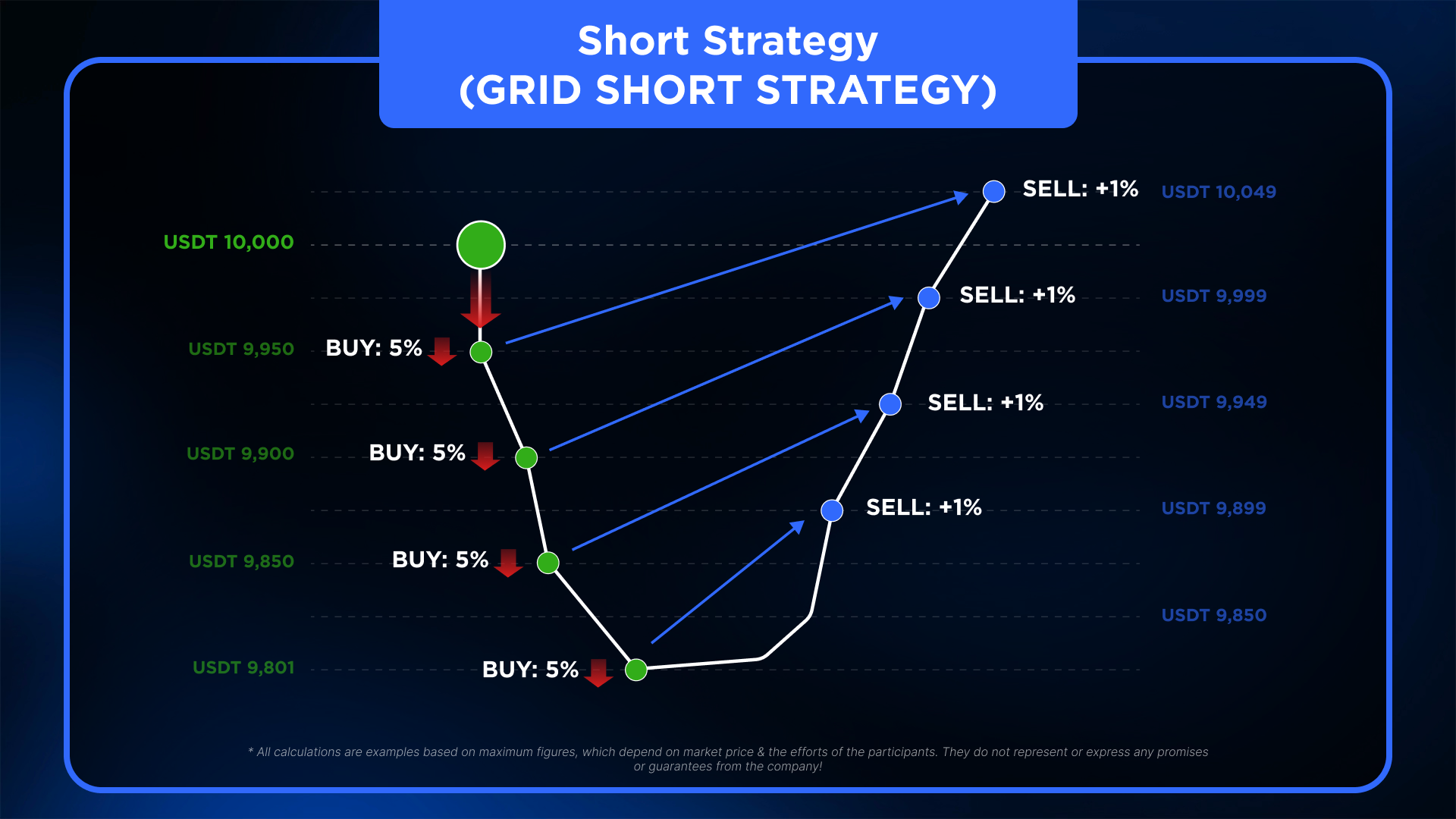

GRID SHORT STRATEGY

- When the price drops by 0.5% from the first purchase price, the bot makes a market buy for 1% of your package value. It then places a limit sell order for that 1% at 0.5% above the purchase price.

- Let’s look at an example: if you have purchased a Basic-level bot license for 605 USDT, when the price drops by 0.5% from the starting price of 1 USDT, the bot will buy 6.05 USDT at the market price of 0,995 USDT and place a limit sell order 0.5% above the last purchase price, at 0,99 USDT.

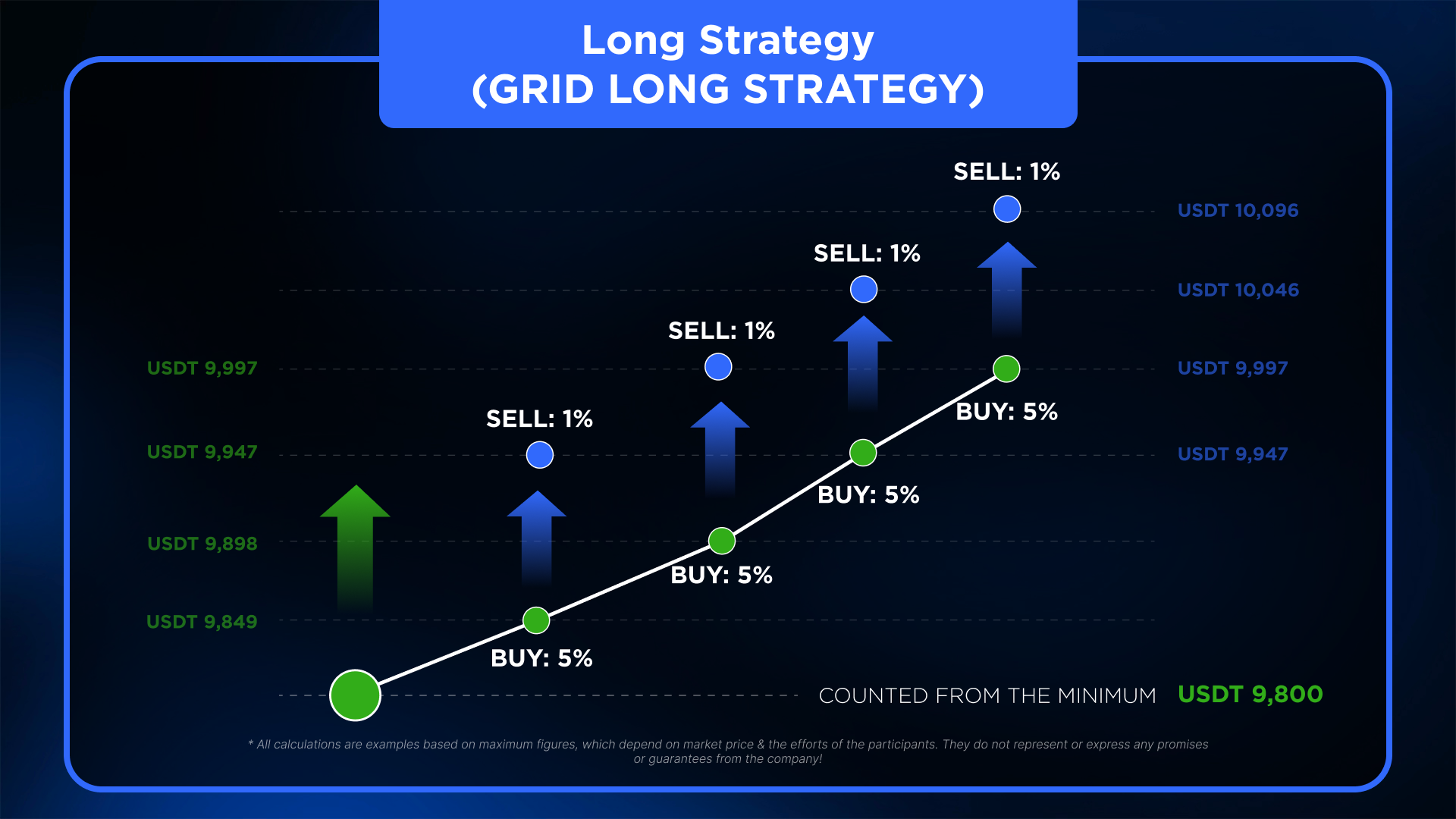

GRID LONG STRATEGY

- In a similar manner, when the bot is launched, the starting price is considered the current minimum. When the price increases by 0.5%, the bot executes a market buy using 1% of your package value, and places a limit sell order at +1% above the purchase price.

- Let’s look at an example: if you have purchased a Basic-level bot license for 605 USDT, when the price rises by 0.5% from the starting price of 10 USDT, the bot will buy 6.05 USDT at the market price of 1,005 USDT and place a limit sell order at 1,015 USDT.

With each subsequent price increase from the minimum price or from the last buy order (whichever is lower) by 0.5%, the bot will make a purchase following the same algorithm.

These strategies are perfectly suited for all market conditions. In this guide, we’ll take a detailed look at each one.

At the first launch, the bot executes a market buy using 50% of your package value and places a limit sell order at a price 5% higher than the purchase price. For example, if you’ve purchased a Basic-level bot license for 550 EUR (equivalent to 605 USDT), the bot will execute a purchase of 302.5 USDT. Let’s say the price of ULTIMA at the time of purchase is 10,000 USDT — the bot will then place a limit sell order at 5% above the purchase price, i.e., at 10,500 USDT.

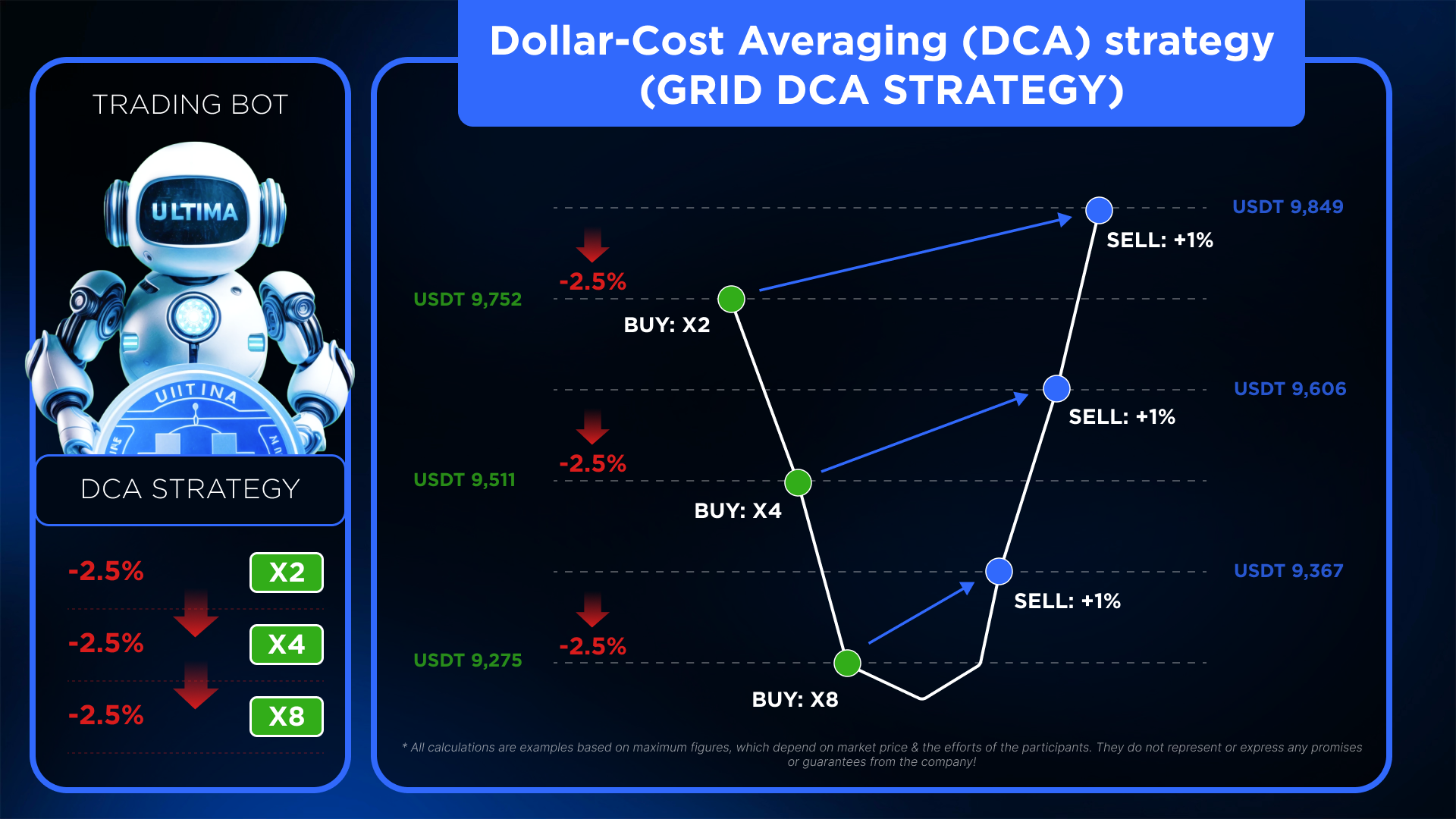

When the price drops by 0.5% from the first purchase price, the bot makes a market buy for 5% of your package value. It then places a limit sell order for that 5% at 1% above the purchase price. If the price of ULTIMA drops more than 2.5% from the moment the bot was launched (i.e., the bot has already executed 5 consecutive purchases, each triggered by a 0.5% drop), then every 5th purchase will begin to double in volume.

In a similar manner, when the bot is launched, the starting price is considered the current minimum. When the price increases by 0.5%, the bot executes a market buy using 5% of your package value, and places a limit sell order at 1% above the purchase price. Accordingly, if you have purchased a Basic-level bot license for 605 USDT, the bot will make a purchase of 30.25 USDT. Assuming the initial purchase was made at 10,000 USDT, then after a 0.5% price increase, the bot buys 30.25 USDT at the market price of 10,050 USDT and places a limit sell order at 10,150.5 USDT. With each subsequent 1% price increase from either the minimum price or the last buy order (whichever is lower), the bot executes a new purchase using the same algorithm.

If the price of ULTIMA continues to drop by more than 2.5% from the bot's launch price (meaning 4 consecutive buys have occurred, each after a 0.5% drop), every 5th buy after that will double in volume. For example: 5th order – 10% of the package value 10th order – 20% of the package value 15th order – 40% of the package value So, if you have a Basic-level bot license worth 605 USDT, the 4th order will be 5% of the package, or 30.25 USDT. Starting with the 5th order, the bot will double the buy volume every 5 orders as long as the price continues to fall: 5th order → 60.5 USDT, 10th order → 121 USDT, 15th order → 242 USDT, and so on.